Uncategorized

Metro Areas Where Employers Influence Cancer Coverage Costs

Metro Areas Where Employers Influence Cancer Coverage Costs.

Employers currently represent approximately 60% of the commercial insurance market dollars. The Employer commercial insurance market consists of more than 95,000 companies with self-insured plans, eighty percent of whom have less than 2,000 employees.

Entering 2017, these employers face double-digit increases in the cost of prescription drugs for their employees and families. For those needing specialty drugs, cost increases may be much higher.

Various types of cancer comprise more than half of the specialty products in the drug pipeline. Additionally, close to half of these specialty products can be considered to be first-in-class oncology therapies. If approved, these treatments may be launched without competition.

Employers are now engaged in an overall effort to drive efficiencies for better quality and lower cost. These cost containment strategies can include: tiered co-payment models, step therapy, formulary adjustments, and prior authorizations.

Employers are well positioned in the market to pilot new models for payment and cancer care that benefit insurers, drug companies and the patient through their benefit design. Employers view all care types and conditions when making benefit coverage changes.

While 2017 remains mostly like what was seen in 2016 benefit plans, we expect to see deeper and broader plan design changes in-play for 2018 that will continue to impact oncology in commercial marketplace.

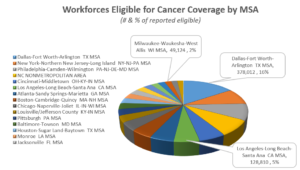

As we take a look across the nation, we see that Employers in certain metro areas may play a leading role in reducing the cost of cancer care through innovative payment and coverage models. The following identifies workforces eligible for cancer coverage by MSA and the leading metro areas which include:

- Dallas-Fort Worth-Arlington

- New York-Northern New Jersey-Long Island

- Philadelphia-Camden-Wilmington

- North Carolina non Metro Area

- Cincinnati-Middletown

Employers are joined by other stakeholders in these metro areas that may play a role influencing cancer coverage and reimbursement, including Employee Benefit Consultants/Advisors, Health Plans, PBMs, Specialty Pharmacies, and providers of ancillary Voluntary benefits.