Specialty Drug

Employers Medical Stop Loss for Specialty Rxs

Employers Medical Stop Loss for Specialty Rxs – Employers will continue to experience escalating specialty Rx costs. Effective but expensive non-substitutable products emerging from pharmaceutical manufacturers’ development pipelines will quickly and sharply drive both pharmacy and medical benefit year-over-year spending increases.

Traditional risk management tools, like stop loss insurance policies are designed to mitigate risk and volatility associated with catastrophic claimants – historically short-term but costly claim exposures. However, chronic conditions, further treated by Specialty Rx, may be catastrophic in claim exposure, and frequently entail significant ongoing expense.

In effect, this creates an unfunded future liability – within an employer’s active health plan – of potentially millions of dollars per diagnosed claimant. With existing stop loss pricing, such ongoing claimants are often excised from coverage in future years. This practice has always been controversial and contentious, and will be even more so with respect to cases in which claims are driven by specialty pharmacy therapies.

There is a need now for employers to begin managing future liability of chronic high cost Specialty Rx claimants. Increasingly, newer pharmaceutical products are targeting previously untreatable conditions such as rare diseases or those that whose disease root cause is now understood through genomic based research efforts. Specialty Rx charges represent both high-profile financial and employee relations risk, which may well require new thinking about, tools for, and enterprise action to address effectively.

Reinsurance is insurance for insurance programs. Typically reinsurance is targeted to self-funded employer health plans, but it is just as necessary for community health plans, ACOs and other health plan payors.

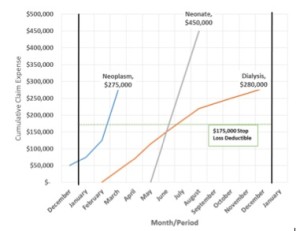

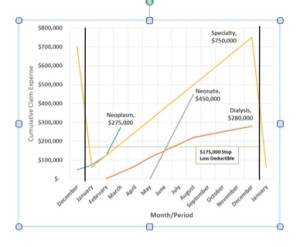

Medical Stop Loss is a risk management tool for self-funded medical plans. In exchange for fixed monthly stop loss premium, it reimburses any claimant, per year, who exceeds a specified deductible. Medical Stop Loss is set by the plan but often from $100,000 to $500,000. It moderates the volatility of high claimants and avoids budget deficits and related ‘catch-ups’.

There are two forms of Medical Stop Loss: Specific, which guards from catastrophic (most common); and Aggregate, which further protects from high utilization. In summary, it’s a budgeting tool which protects self-funded plans from financial calamity

Stop loss pricing will need to account for both expense and duration of costly specialty therapies.

Future Stop Loss Underwriting – Inclusive of a Reserve Component

- Reflects both traditional short-term claims as well as ongoing diagnoses

- An additional reserve component permits ongoing coverage into future periods

- The occurrence of lasers should be greatly reduced if not required

- Premiums will be higher, as is the newfound risk, but offers predictability of expense

- Opportunity exists for a specialty pharmacy only stop loss product as well

- Underwriters will welcome partnership with manufacturers to control drug costs